In 1896, Orville and Wilbur Wright were two brothers running a bicycle manufacturing company out of Dayton, Ohio.

Inspired by photographs and magazine articles about flight, the brothers attended several aeronautical events that displayed and tested different types of gliders across the US.

Drawing on the inspiration of Leonardo Da Vinci, the Wright Brothers decided to experiment with flight – investing in and building various gasoline powered aircrafts.

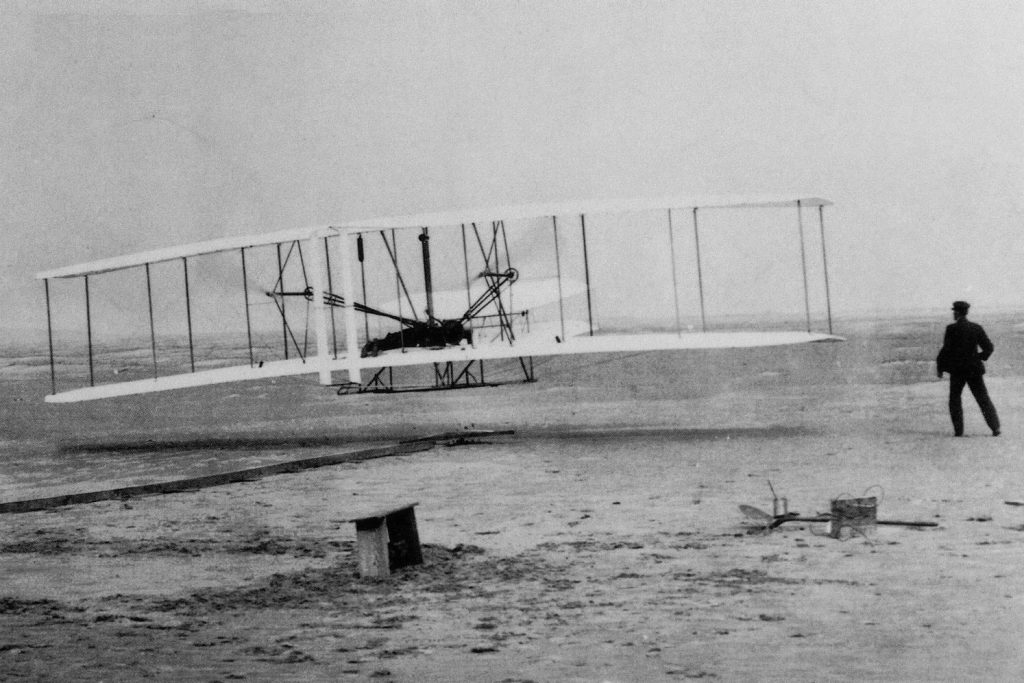

To test their aircrafts, they chose a now world-famous location: Kitty Hawk, North Carolina.

Kitty Hawk was a unique location for the Wright brothers. It gave them privacy from reporters and the wind in the air was strong.

Most importantly, however, Kitty Hawk was a vast plain of extremely soft grass the brothers could practice on without getting hurt.

The brothers chose this location because knew they were going to fail and crash. A lot.

But rather than being discouraged by the fear of failure, they mitigated the risk of their inevitable failures – and changed the course of history.

The brothers didn’t jump off bridges, or massive cliffs.

Instead, they found a soft plot of land on which they could fail over and over again until they succeeded.

Compare the Wright Brothers’ accomplishment to that of Franz Reichelt, a French-Austrian tailor who in 1912 was convinced he had built a successful parachute.

To test out his invention, he decided to jump off the Eiffel Tower. When he did, the parachute didn’t deploy, and he died a tragic, quick death in front of 30 terrified journalists.

This difference between the Wright Brothers and Franz Reichelt is one of the most important lessons in personal finance – and in life.

In investing, most people think like Franz Reichelt. They believe they need to take outrageous risks to get any kind of return.

Unlike Franz Reichelt, however, most people never jump. Paralyzed by the fear of failure, they never take any risk whatsoever.

That’s why most people never succeed financially. Rather than mitigating risk, they avoid it altogether.

But avoiding risk is one the surest way to financial mediocrity.

Building wealth and being successful in business and investing requires taking some level of risk.

But that doesn’t mean that what you do has to be risky.

It simply means managing risk like the Wright Brothers – making sure that any upside massively outweighs any downside.

Getting there isn’t rocket science. It simply means expanding your reality of what’s possible.

We all know from experience and history that failure is an inevitable part of success. If you think you’ll have no bumps in the road, you’re in for a reality check.

So I encourage you not to run away from risk.

Instead, make it a priority to ensure that when you fail, the landing is soft enough for you to get back up again.

To freedom,